Accounts Payable Update for April

Sent to the AFS-Update mailing list on April 18, 2025

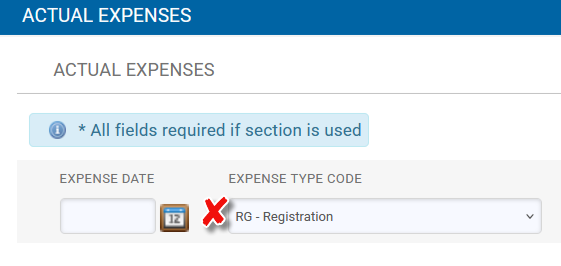

Travel Reimbursement (TR) eDoc: Expense Type Code List – Action Required

We want to inform you of an important update to Travel Reimbursement (TR) Expense Type Codes. Effective Friday, April 18, 2025, please stop using the Expense Type Code: RG – Registration.

The new and appropriate Expense Type Code to replace RG will be CF – Travel Conference Fee or Registration. For travel conference fees or registration fees to attend a meeting that includes travel expenses use the Expense Type Code CF, the object code will default to 8320 to travel registration fee.

The new and appropriate Expense Type Code to replace RG will be CF – Travel Conference Fee or Registration. For travel conference fees or registration fees to attend a meeting that includes travel expenses use the Expense Type Code CF, the object code will default to 8320 to travel registration fee.

Why This Change Is Needed

- A recent audit revealed that many conference registration fees were incorrectly posted to object codes 8340 (Travel International) and 8350 (Travel within US).

- This occurred because these object codes are the current defaults for the RG-Registration expense type in the Travel Reimbursement (TR) document.

- On and after July 1, 2025, Travel Reimbursement eDocs with RG – Registration found in the Expense Type Code will be returned to the initiator to make the change to CF - Travel Conference Fee or Registration.

The Key Changes

| TR eDoc | Actual Expenses Tab: Expense Type Code |

Accounting Lines Tab: Default Object Code |

| Current | RG – Registration | 8340 – Travel International 8350 – Travel within US and Possessions |

| New | CF – Conference Fee or Registration | 8320 – Travel Registration/Conference Fees |

IMPORTANT NOTE: Initiators/arrangers copying a Travel Reimbursement (TR) document that previously used the RG Expense Type Code, you will need to update the expense code to CF to ensure the Object Code (8320) routes correctly. Best business practice is to create a new KFS TR document.

Entertainment Policy Training Now Available Online!

The Travel Accounting and Financial Management Support teams are pleased to announce a new training in UCLC on the University’s entertainment policy, UC Policy BUS-79. This class is designed for anyone who prepares or approves payments or reimbursements for events, meetings, or other entertainment expenses. The eCourse can be found in the UC Learning Center (UCLC).

Register on UCLCTo complete this eCourse, search for "Entertainment" on the UCLC website and follow the instructions to register for the Entertainment Reimbursement Policy Training.

Move/Relocation Reimbursements – New Website

We are excited to announce a major update to the Moving & Relocation website, designed to better serve new employees and staff. Because UC moving and relocation policy differs depending on the employee’s job title, there are now specific tabs for each appointment type.

To find the applicable policies, forms, and requirements to be reimbursed on a timely basis, just select from the three following types:

- Academic Appointees

- Managers & Senior Professionals (MSP) or Professional and Support (PSS) Appointees

- Senior Management Group (SMG)

Visit the Website: https://accounting.uci.edu/moving/ (select the relevant tab for information)

More Moving and Relocation Reimbursement Reminders

- All receipts are required for move and relocation reimbursement.

- New customized UCI Relocation Expense forms are in each tab. This is a required form to be signed by the new employee and department approver.

- Employees should be aware all moving household and personal removal expense reimbursements are taxable/reportable. Taxes will be automatically deducted from the payment and reported on the employee's current year W-2. Amounts will be treated as taxable whether they are reimbursed to an employee or paid directly to a vendor.

Tips for Reimbursement of Meal Expenses

Based on UC Policy BUS-79, Expenditures for Business Meetings, Entertainment and Other Occasions, the definition of a meal is:

A Meal is a catered or restaurant-provided breakfast, lunch, or dinner at which employees, students, or other individuals are present for the purpose of conducting substantial and bona fide University business. Groceries and beverages purchased for an event may also be charged as meal(s).

Keep the following in mind when it comes to reimbursing meal expenses:

- Payment to a vendor for meal tickets, card swipe, vouchers, Flexdine meal plan, and concession stand tickets are not considered a catered or restaurant provided meal for the purpose of conducting business. For the service provided by the vendor, pay on a Disbursement Voucher (DV) eDoc, Reason Code O.

- Meals served at UC BUS-79 meetings should be a meal catered or restaurant-provided breakfast, lunch, or dinner at which employees, students, or other individuals are present for the purpose of conducting substantial and bona fide University business. An attendee name list (first and last name) is required documentation and the per person cost of the meal.

Virtual Meetings: Delivery of meals for virtual meeting attendees is not allowed. The host and attendees must all be physically present at the event.

Travel Expense Tips: Trip Protection, Flight Insurance & Hotel Protection Fees are Not Reimbursable

Trip protection, flight insurance, and hotel protection fees are not reimbursable under University of California policy. This is because travelers on UC business are reimbursed for business trip expenses – including rescheduling/cancellations fees with a valid business reason. As a result, trip protection, flight insurance, and hotel protection services are unnecessary.

Trip protection, flight insurance, and hotel protection fees are not reimbursable under University of California policy. This is because travelers on UC business are reimbursed for business trip expenses – including rescheduling/cancellations fees with a valid business reason. As a result, trip protection, flight insurance, and hotel protection services are unnecessary.

Per UC Policy G-28 (pg. 11), charges for schedule changes are reimbursable if incurred for a valid business reason and the traveler can show the cancellation was the result of circumstances beyond the traveler’s control. The reason for the changes must be explained on the Travel Reimbursement eDoc and proof uploaded to the Image scanning tab such as airline documents, traveler’s email explanation or screenshots of the cancelled flight/hotels, political tensions, extreme weather, etc.

For accident/medical and trip interruption/cancellation coverage questions, please contact Risk Management Manager: richmon1@uci.edu or riskmgmt@uci.edu.

For more information, please visit the UCOP website: https://www.ucop.edu/risk-services-travel/index.html

TEM/DV Required Approvals Must be in the Route Log

The Route Log of a KFS document is the primary way central accounting tracks approval of Travel and Event Management (TEM) eDocs and Disbursement Vouchers (DVs). Check your route logs to make sure the appropriate approvers are reflected there.

The Route Log of a KFS document is the primary way central accounting tracks approval of Travel and Event Management (TEM) eDocs and Disbursement Vouchers (DVs). Check your route logs to make sure the appropriate approvers are reflected there.

To ensure timely payments, please see the examples shown below:

- TEM eDoc and DV approval from the designated department fiscal officer and accounting reviewers must appear in the Route Log.

- Sometimes Additional or Exceptional Approval is required. Make sure the designated exceptional approvers from normally the Deans or Equivalent or Above in Title for travel and entertainment or additional approvers for entertainment reimbursement eDocs are in the Route Log PRIOR to Accounting Review. For more information, please visit: Additional and Exceptional Approvals for Travel, Meetings, and Entertainment.

- For DV Reason Code C for research payments, the PI’s approval must be in the DV Route Log. Reimbursement to a PI, the Chair or Dean’s approval must be in the Route Log. Approval signatures on forms in scanned images will not be sufficient for audit, and post audits.

- For DV Reason Code E for honorarium payments, the exceptional approval must be in the DV Route Log. Approval signatures on forms in scanned images will not be sufficient for audit, and post audits.

DV Reason Code Q: Program Sponsorships

Donations or sponsorship payments must be a payment from UCI to an organization, foundation, or vendor. They may not be a reimbursement to an individual. Please keep in mind the following when creating a Disbursement Voucher (DV) using reason code Q.

Donations or sponsorship payments must be a payment from UCI to an organization, foundation, or vendor. They may not be a reimbursement to an individual. Please keep in mind the following when creating a Disbursement Voucher (DV) using reason code Q.

- The proper procedure is to pay directly to the vendor by UCI with a Disbursement Voucher eDocument, Reason Code Q

- Onboard the vendor to send a payment.

- The object code to be used for the DV, Reason Code Q is 7060.

- A Transmittal Letter is required in scanned images and anyone in the department may sign the transmittal letter. Example Transmittal Letter link - https://www.accounting.uci.edu/ap/_files/transmittal-letter-example.pdf

- The delegated Program Sponsorship Approver from normally the Deans or Equivalent or Above in Title must be in the DV Route Log PRIOR to our review.

- The vendor’s Invoice/Correspondence Request must be uploaded to scanned images and the address on the vendor’s Invoice/Correspondence Request must match the address on the DV, Payment Information tab in KFS, for accurate reporting to UCOP and to help make sure the payment is sent to the correct vendor & address.

For more information, review the Program Sponsorship Requirements and the Reference Guide to Required Supporting Documents.

Enforcement of REAL ID Requirements Starts May 7

The REAL ID Act is being enforced starting May 7, 2025. Travelers 18 and over will need a REAL ID-compliant license or another acceptable ID to board commercial domestic flights and access federal facilities.

The REAL ID Act is being enforced starting May 7, 2025. Travelers 18 and over will need a REAL ID-compliant license or another acceptable ID to board commercial domestic flights and access federal facilities.

For more information, visit the Department of Homeland Security's website or contact your local state office responsible for issuing driver’s licenses.

Find The UC Policies & Guidelines

- UC Irvine Sec. 715-01: Policy on Travel Authorization and Approval

- UC Policy G-28: Travel Regulations

- UC Policy BUS-79: Business Meetings and Entertainment

- UC Policy BFB-G-13: Moving and Relocation

- Removal Expenses/General for Academics, APM-560

- UC Regents Policy 7710: SMG Moving Reimbursement

- UC Policy G-41: Employee Non-Cash Awards and Other Gifts

- UC Policy G-42 Gifts Presented to Non-Employees on Behalf of the University

- Honorarium Overview

Please visit our travel website for information: https://accounting.uci.edu/ap/travel/

Accounts Payable Remote Business Hours

Monday through Friday from 8 a.m. to 5 p.m.